You can choose the annual or monthly cost of the basic package of FAMIGLIA banking services:

- 2500 UAH per year

- from 0 UAH/month to 300 UAH/month*.

*Monthly payment will be 0 UAH, subject to the conditions of “Smart Pricing”, namely the availability of average daily card balances from 25 000 UAH ( eq.) / month or the amount of card purchases from 7 000 UAH ( eq.) / month, (as of 01.02.2026, from UAH 15,000 (equiv.)/month for the "Family" service package)

- from 0 UAH/month to 450 UAH/month**, (as of 01.02.2026, UAH 500/month for the "Family" service package)**.

** monthly payment will be 0 UAH, subject to the conditions of “Smart Pricing”, namely the availability of average daily card balances from 50 000 UAH ( eq.) / month or the amount of purchases with cards from 15 000 UAH ( eq.) / month, (as of 01.02.2026, from UAH 25,000 (equiv.)/month for the "Family" service package).

When analyzing the monthly fee, balances/turnover on cards in foreign currency are also taken into account.

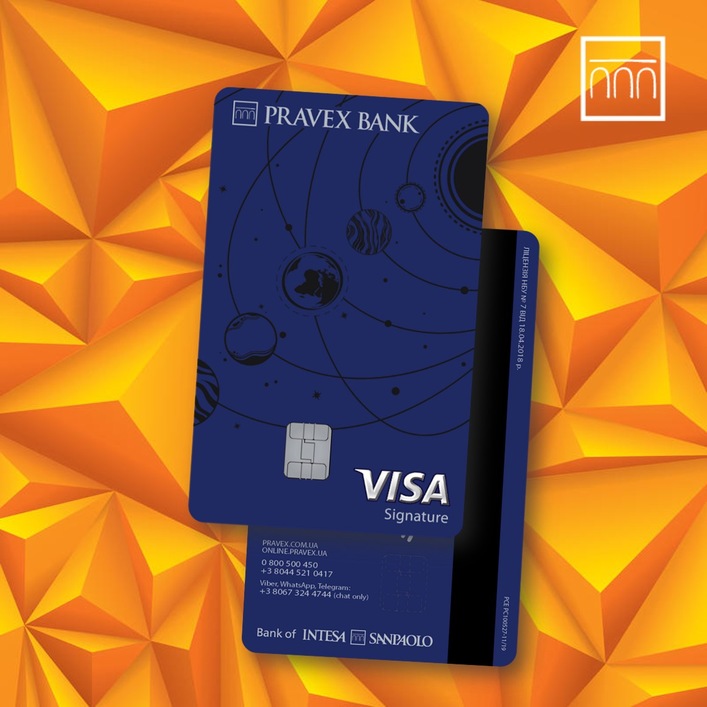

Premium cards and accounts for the whole family

Premium cards and accounts for the whole family